colorado springs sales tax online

Cookies are required to use this site. For a Retail Sales Tax License make check payable to the City of Colorado Springs.

1521 N Weber St Colorado Springs Co 80907 Mls 9573524 Zillow Colorado Springs Real Estate Colorado Springs Colorado

Go to the account you want to close and click Additional Actions For Sales Tax accounts be sure to select the Sales Tax account not your Sales Tax LicenseRenewal accounts.

. Download all Colorado sales tax rates by zip code. The Colorado sales tax rate is currently 29. The County sales tax rate is 123.

Your browser appears to have cookies disabled. Recent Colorado statutory changes require retailers to charge collect and remit a new fee. 719 385-5291 Email Sales Tax Email Construction Sales Tax.

If you close your Sales Tax LicenseRenewal account it will not close your entire Sales Tax account. Box 1575 Colorado Springs CO 80901-1575. Return and payment due on or before January 20th each year.

Youll then get results that can help provide you a better idea of what to expect. Welcome to the City of Colorado Springs. Businesses with a sales tax liability between 15-300 per month.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs. Please click the below button to be directed to the login portal where you can access an existing account or register for a new one.

For additional e-file options for businesses with more than one location see Using an. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. Sales Tax Filing and Payment Portal Powered by.

City of Colorado Springs Sales Tax PO. Go to the Retail Delivery Fee web page for information on how to begin collecting and remitting this new fee. The Colorado Springs sales tax rate is 307.

The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. This system will greatly improve our businesss experience by allowing businesses to file. Box 1575 Colorado Springs CO 80901-1575.

City of Colorado Springs Sales Tax 30 South Nevada Avenue Ste 203 Colorado Springs CO 80903 8-5pm M-F. The Colorado Springs Sales Tax is collected by the merchant on all qualifying sales. Did South Dakota v.

Log in to Revenue Online. Login management for this system is primarily facilitated through the Okta single sign-on provider. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is 82.

Download all Colorado sales tax rates by zip code. The current total local sales tax rate in Colorado Springs CO is 8200. For a Retail Sales Tax License make check payable to the City of Colorado Springs.

City of Colorado Springs Department 2408 Denver CO 80256-0001 Online Services instructions additional forms amended returns are available on our website. Single Sign-on SSO Use Okta. ColoradoSpringsgov search Sales Tax If reporting use taxes on line 8 of this tax return please attach Schedule B use tax detail report or like schedule.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in Colorado Springs Colorado. Businesses with a sales tax liability of up to 15month or 180year. Colorado Springs CO 80903.

What is the sales tax rate in Colorado Springs Colorado. Colorado Springs CO Sales Tax Rate. If you have more than one business location you must file a separate return in Revenue Online for each location.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale delivered by motor vehicle to a location within Colorado. Sales Tax Rates in the City of Glenwood Springs.

This is the total of state county and city sales tax rates. Return and payment due on or before the 20th of the month following the end of each quarter. City of Colorado Springs Sales Tax 30 South Nevada Avenue Ste 203 Colorado Springs CO 80903 8-5pm M-F.

There are a few ways to e-file sales tax returns. Plus Tax Amount 000. City of Colorado Springs Sales Tax PO.

Minus Tax Amount 000.

Coleman Community Park Master Plan Colorado Springs

Sales Tax Information Colorado Springs

Amazon Distribution Center In Colorado Springs Has Thousands Of Robots Business Gazette Com

New Downtown Parking Rates And Hours Go Into Effect Colorado Springs

Easiest Way Of Filing Federal Taxes To Government Http Www Onlinefiletaxes Com Income Tax Return Income Tax Tax Return

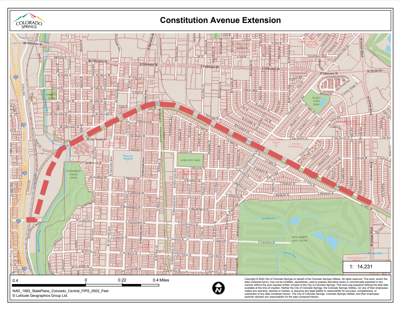

Major East West Colorado Springs Street Extension Reignites Old Battle Subscriber Only Content Gazette Com

Taxes In Colorado Springs Living Colorado Springs

Pikes Peak Avenue Colorado Springs Co Colorado Springs Pikes Peak Colorado

Cheap Flights From Phoenix Sky Harbor To Colorado Springs From 40 Phx Cos Kayak

Sales Tax Information Colorado Springs

Rv Vacation Between Colorado Springs Denver At Colorado Heights Camping Resort Camping Resort Camping Colorado Colorado Vacation

Incentives Taxes Colorado Springs Chamber Edc

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Sales Tax Information Colorado Springs

Incentives Taxes Colorado Springs Chamber Edc

Red Rocks South 8 000 Seat Outdoor Amphitheater Planned In North Colorado Springs Thetribune Gazette Com

How Colorado Taxes Work Auto Dealers Dealr Tax

Job Opportunities Sorted By Job Title Ascending Career Pages